What is it and what is it used for?

The census of ground floor premises intended for economic activity in the city of Barcelona records all the ground floor premises in the city which are intended for economic activity and which are currently active or pending activity. It is an essential instrument for diagnosis, systematising indicators, decision-making and for assessing public policies for this sector.

The census provides an accurate snapshot of the state of economic activity and the commercial offer in Barcelona, with the aim of keeping city residents and businesses informed, along with all the key stakeholders that play a role in the city’s economic, social and urban-planning dynamics.

How is it conducted?

Since 2016, the census has been periodically updated with large field operations that have enabled a full picture to be built up of ground floor premises throughout the city. This has made it possible to identify ground floor premises that either host an economic activity or have the potential to do so.

Since 2021, Barcelona City Council has been developing a methodology for continuously updating its data on the sector, and this has led to the creation of the census of ground floor premises intended for economic activity in Barcelona. This is a census that focuses exclusively on analysing premises used for economic activities.

Study of economic activity in ground floor premises by sample area (2022-2023)

Due to episodes such as the Covid-19 pandemic, the outbreak of war between Russia and Ukraine, the resumption of tourism and Barcelona’s commitment to reducing polluting emissions, the city has needed agile, ongoing mechanisms that enable frequent analysis of commercial activity in ground floor premises.

For this reason, it has designed a methodology to allow it to monitor sample areas that are representative of the city, within a short time frame, in order to conduct detailed analyses of trends detected during its ongoing monitoring efforts. This methodology also makes it possible to get a quick, accurate picture of the situation of ground floor premises used for economic activity, without losing the bigger picture of the city as a whole.

Which are the sample areas?

Eighteen of these areas have been marked out, taking into account aspects such as the concentration of commerce, the type of environment, commercial hubs and tourist hotspots, among others. Together, the sample areas are home to 8,000 premises, more than 10% of those in Barcelona.

What data does the study assess?

In total, since the completion of the analysis of the whole city in September 2022, two street-level inspections have been carried out of the sample areas (2022 and 2023). The results have been compared with the analysis and the report produced in 2019, before the pandemic, to assess how the situation with regard to commercial premises had evolved from the time before the pandemic up to the first quarter of 2023.

The key results:

Post-pandemic reactivation (IRCA and ITR)

The Current Commercial Recovery Index (IRCA) shows the percentage of active establishments in 2023 compared to 2019. The Recovery Trend Indicator (ITR) shows the evolution of the recovery as a percentage, between 2023 and 2022 (IRC-IPP). The results of both indexes show the rapid recovery of commercial activity at street level in the post-pandemic era.

Post-pandemic stability (IRC)

The Commercial Recovery Index (IRC) is a recovery indicator that takes into account the trend index and the current commercial recovery index. It shows a full recovery in Barcelona, with sample areas exceeding the volume of activity in 2019, and a positive trend.

The five neighbourhoods where activity had fallen by more than 5% have made a good recovery. For example, the Gothic Quarter, which was hit particularly hard during the pandemic, has made a recovery of 16%. So it shows the recovery in the sample areas where the effects of the pandemic were felt most sharply.

Estudi de les activitats comercials a Barcelona 2022

Sabies que a Barcelona hi ha 58.908 establiments que tenen una activitat econòmica vigent a la planta baixa? D'aquests n'hi ha 20.749 que són comerços al detall i 32.004 dedicats als serveis, segons el darrer estudi de les activitats comercials a Barcelona 2022, amb dades recollides fins al 30 de setembre de 2022.

Alhora, l'anàlisi dels resultats té en compte els efectes que ha tingut la pandèmia de la COVID-19 sobre l'activitat econòmica als locals de planta baixa de Barcelona.

Els principals indicadors de salut comercial:

L'abastament comercial

La ciutadania de Barcelona té al seu abast una oferta de comerç molt abundant. L'índex de l'abastament comercial és de 3,59: hi ha de mitjana gairebé quatre locals amb ús comercial per cada cent habitants

L'aprofitament comercial

Barcelona té un índex d'aprofitament comercial alt: el 89,14% dels locals de planta baixa destinats a l'activitat econòmica estan en actiu. L'indicador que avalua la proporció entre locals ocupats i el total de locals censats

El comerç ocasional

L'índex de comerç ocasional mitjà de Barcelona és 15,58%. Principalment, l'oferta va destinada a cobrir les necessitats d'equipament de la persona i de la llar, així com culturals i de lleure. Ciutat Vella és el districte amb un nombre més alt d'establiments de comerç ocasional, amb un valor del 23,81%.

El comerç quotidià

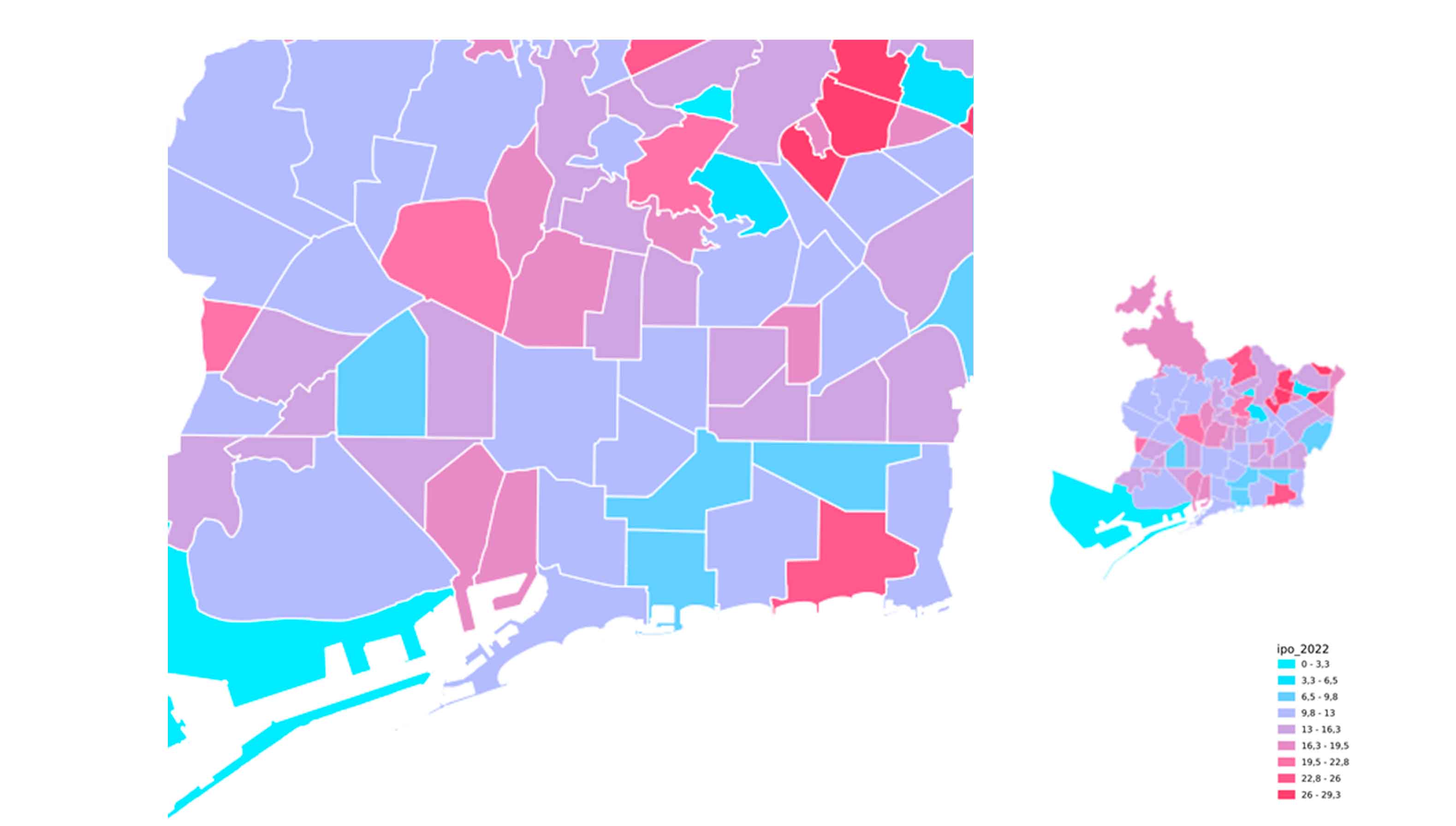

L'índex de comerç quotidià, una de les novetats de l'estudi, és un indicador que mesura la proporció de comerç quotidià respecte del total d'establiments (actius i buits), en aquest cas, 13,27. S'hi han inclòs els establiments d'abastament d'aliments, de productes de neteja i les entitats financeres. Els tres districtes que destaquen respecte a la seva dotació de comerç quotidià són Nou Barris (16,34%), Horta Guinardó (14,34%) i Sants-Montjuïc (13,88%).

La restauració

L'índex de restauració mostra que el sector atrau nombrosos residents, treballadors i visitants de la ciutat que gaudeixen de l'oferta variada de bars i restaurants. De cada cent locals disponibles, 16,23 es destinen a la restauració.

Conclusions

· An occupied ground floor in the city which guarantees the supply needs of city residents. Despite the slight downward slide in the indicators that measure the commercial health of the city, the indices for supply, commercial occupation, casual trade, and bars and restaurants remain good.

· Tendency towards specialisation and concentration of shops and services. The city’s shops and services tend to be specialised and are concentrated in particular areas. For example, Eixample, Ciutat Vella, Sant Martí, Sarrià-Sant Gervasi and Gràcia are home to 66.7% of all retail shops in the city.

· A wealth of commerce. With around 60,000 active establishments and more than 3.5 establishments for every 100 inhabitants, Barcelona has a commercial fabric that guarantees the supply needs of its residents. Furthermore, a reading of broad categories comparable to the references of the Commerce Observatories in Europe shows that one in three establishments is dedicated to various services (36.12%), while non-food establishments (21.72%) and restaurant services (18.2%) account for one in five establishments.

Co-financed by: